Skailark launches Airline Economics v8.0

| We have just updated to v8.0. Please find below a summary of the most important product enhancements: Model and dashboard updates 1.1 MRO cost model v3.0 launch 1.2 Revenue model update and new Revenue dashboard 1.3 ATC cost model update 1.4 Onboard cost model update Data updates 2.1 Additional airline added 2.2 Updated Q3 financials and added Q4 forecasts Technical improvements 3.1 Adjustments & bug fixes |

| All our subscribers have received complimentary access to the updated data as of today. We welcome any feedback, both on insights as well as usability. Note: To access data from any previous versions, please access our archive here. |

Model and dashboard updates

| 1.1 MRO cost model v3.0 launch We completely rebuilt our MRO cost estimation engine with the goal to (1) provide more granularity and (2) increase accuracy further. Highlights include: – Airframe events: A core innovation is the model’s advanced D-check cost estimation approach. It assigns D-check activity based on actual aircraft movements and time spent at overhaul locations. Costs are calculated using labor rates at these specific locations. This enables our customers to understand the cost impact from differences in timing and location planning of major checks. – Components: We have added more granularity on component types. Component MRO costs are now split by: – Wheels and brakes – Landing gear – Thrust reversers – APU – Other components – Line: Now taking into account different labor rates based on the location of the aircraft and airline. – MRO Burden / overhead cost calculation has been adjusted to further take into account fleet size, aircraft type and business complexity. – Inflation and fleet size effects are now specifically modeled for each airline and aircraft across the globe. The additional granularity and supporting information (such as D-check intervals and % of D-checks performed outside of HQ) is now available in the OWN/MRO dashboard. With this updated data, our customers can: – Identify actionable cost saving opportunities from overhaul timing. – Identify actionable cost saving opportunities from overhaul location. – Estimate impact of aircraft utilization and fleet sizes. – Understand the cost curve(s) of maintenance over the lifespan of an aircraft. |

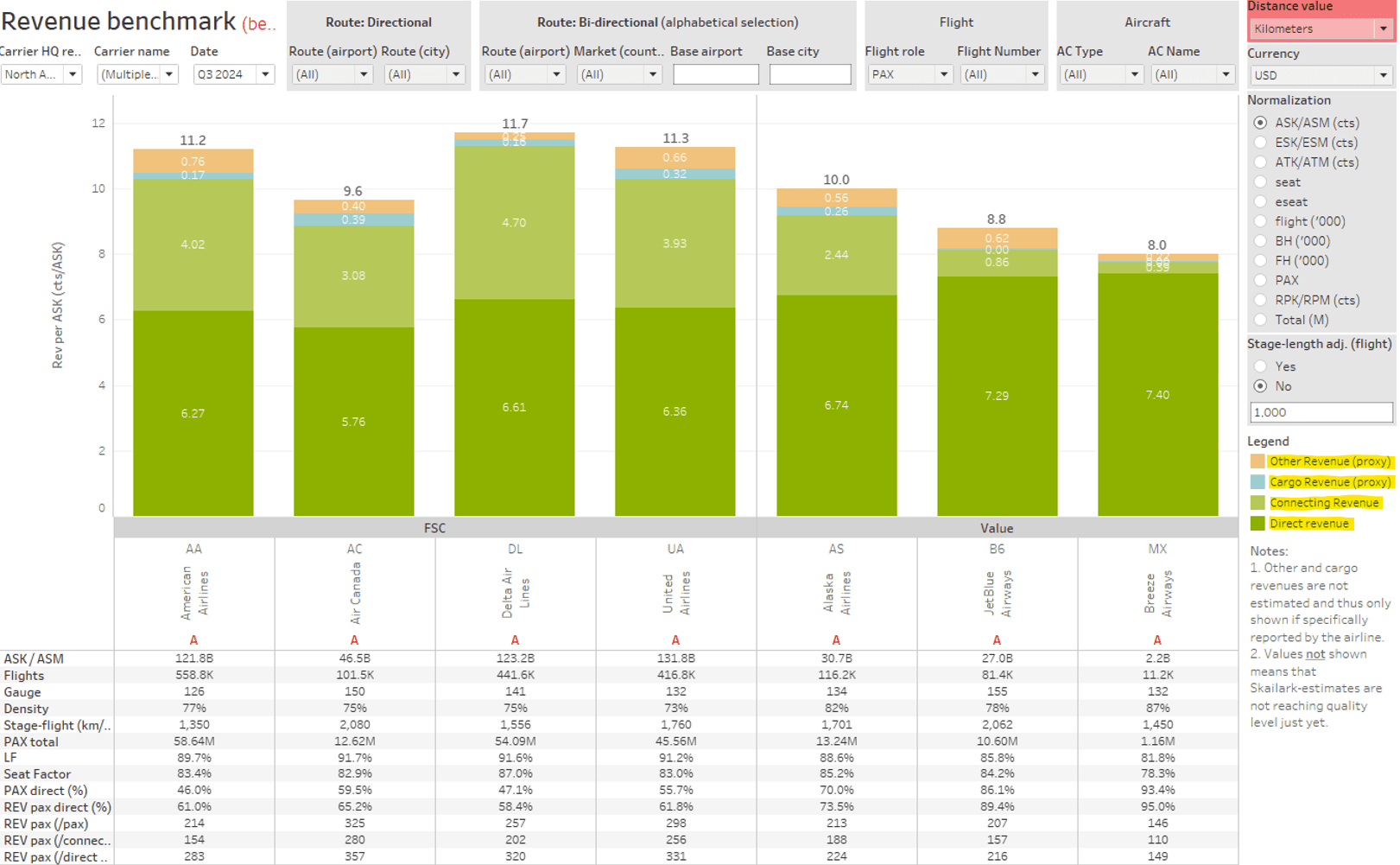

| 1.2 Revenue model update and new Revenue dashboard Our revenue data has been further enhanced to provide deeper insights: – Passenger demand: We have increased accuracy of passenger flows and resulting segment data through the following adjustments: Implemented a factor for alternative travel time between cities, especially improving output quality for flights to and from islands. Adjusted the catchment logic for smaller airports to take into account the demand from travelers coming from farther away. – Yields and revenue: Added new transatlantic yield training data for our machine-learning models to understand additional dependencies. Improved forecasting and proxy logic whenever airlines have not reported detailed financials. – Launch of new Revenue dashboard: The new dashboard is designed in accordance to the existing cost and profit dashboards for easy understanding. Revenues are broken down into direct and indirect revenue. Additionally, proxies for cargo and other revenues are also displayed. This dashboard replaces the previous “Revenue by route” dashboard, while it continues to maintain the functionality of route-based benchmarking. |

| 1.3 ATC cost model update We have furthermore updated our ATC cost model. – Country-specific details: Expanded specific conditions for overflight fees to provide improved ATC cost detail. – Reduction of proxies: Enhanced accuracy by reducing reliance on estimates and introducing more precise metrics. |

| 1.4 Onboard cost model update Our Onboard service data has been upgraded to reflect greater detail. It now includes detailed service-level data for an additional 40 airlines. |

Data updates

| 2.1 Additional airline added We are pleased to announce the addition of carrier Wamos Air. 2.2 Updated Q3 financials and added Q4 forecasts As you are already acquainted with by now, we have validated our Q3’24 forecasts with reported actual financials (where available). Furthermore, we have added Q4’24 supply data including our latest outside-in forecasts. |

Technical improvements

| 3.1 Adjustments & bug fixes Based on customer input, we have added/adjusted further key parts to our digital twin. We have received feedback from various customers and improved data across the board. Crew model: We enhanced mapping accuracy for carrier-specific salary data and adjusted the proxy logic. We have incorporated more F41 data to improve our crew salary calculations. If you have questions about the update or need further support, feel free to get in touch. |