At Skailark, we have again been very busy: we have fully revamped our Aircraft Ownership and ATC models. Both models allow even more bottom-up accuracy and additional functionalities, route-by-route and aircraft-by-aircraft. Read-on what’s new across our digital twin of the industry.

New Aircraft (AC) Ownership model

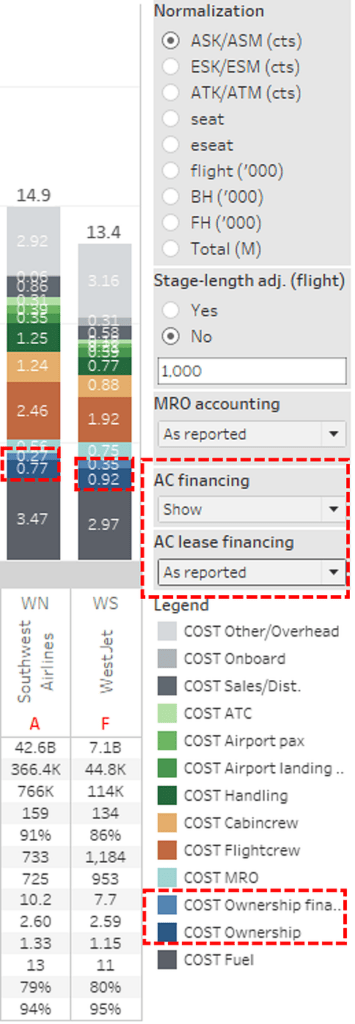

We have updated our bottom-up ownership calculations with the following new features. See the screenshot on the right, highlighting new selection options across our dashboards:

- Updated AC discount model: Yes, we estimate the discounts on list prices each airline received on each AC deal. We have updated our proprietary model based on further data analysis and research.

- Type of lease: Our lease cost calculations now differentiate between operating and financing leases.

- AC financing: We further started to estimate both airline and lessor financing cost using reported interbank rates, taking into account the impact of rising and decreasing interest rates.

- Accounting of AC lease financing: Under IFRS16, the financing portion of aircraft leases shall be separated and reported as a financial expense. Under US GAAP, the financing portion remains part of the operating cost. This limits comparability of AC ownership costs between airlines headquartered in the US and elsewhere. To enable comparison, we now provide the option to toggle between accounting approaches for ownership and financing costs

As a result, you will notice that both Ownership and Ownership financing cost have changed. In case you would like to review ‘older’ data, please revert to our Tableau Online archive.

New ATC (Overflight) model

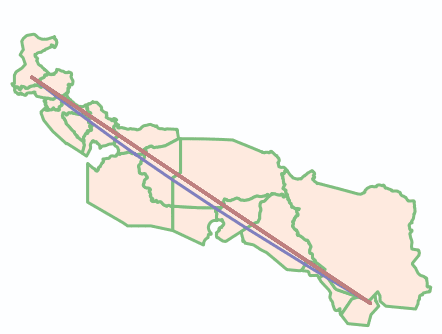

For out bottom-up overflight ATC cost model, we have integrated a new analytical approach. Essentially, for every flight in the world, we estimate the flight path above each flight information region (FIR) and calculate the distance and respective cost that is charged by the respective nation.

The bottom-up approach let’s us take into account the actual configuration of the aircraft (think aircraft type, MTOW, wingspan) and flight (operating airline, time-of-day) to get as close to reality as possible.

Updated Q2 Financials and new Q3 Supply data

As you are already acquainted by now, we have also validated our Q2 forecast with reported actual financials (where available). Further we have added Q3 supply data including our latest financials forecasts.

Additional airlines

We have added new airlines to our active regions:

- North America: Porter Airlines (PD), Lynx Air (Y9)

- Europe: Volotea (V7), Condor (DE)

Are you interested to learn more about Skailark’s Airline Economics product? You can book a meeting with us here.